idaho estate tax return

Idaho has no estate tax. Include Form PTE-12 with.

Idaho Estate Tax Everything You Need To Know Smartasset

7 rows Idaho might require an Idaho individual income tax return Form 40 or Form 43 for the last.

. The North Dakota estate tax is a pickup tax based upon the credit for state death taxes as computed on the federal estate tax return. Sarah FisherMar 03 2020. Nobody wants to hear from theIRS âand I mean nobody.

Farming and ranching production exemption. To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801. Idaho Estate and Transfer Tax Return must immediately be filed along with a copy of the amended Federal Estate Tax Return.

Fiduciary - An automatic six-month extension of time to file is granted until 6 months after the original due date of the return. Idaho State Tax Commission Estate Tax PO Box 36 Boise ID 83722-0410 1. A full copy of the federal estate tax return form 706 must be filed with this return.

Line 5 Income Distribution Deduction Enter the amount of the deduction for distributions to beneficiaries. Treasure Valley Concerned Over Rise in IRS Estate Tax Audits. You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return.

Letter to Idaho State Tax Commission transmitting Tentative Idaho 345 Transfer and Inheritance Tax Return 29. Learn about New Mexico tax rates for income property sales tax and more to estimate your 2021 taxes. Please contact the Estate Tax Section Illinois Attorney Generals Office with any questions or problems.

New Mexico state income tax rates range from 0 to 59. Idaho has no state inheritance or estate tax. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004.

The final Idaho return for the trust or estate. Using tax software for free tax year 2021 The State of Idaho has partnered with the IRS and certain tax software companies to allow qualifying taxpayers to prepare their federal and Idaho. Find IRS or Federal Tax Return deadline details.

100 West Randolph Street. Also you are required to file an estate tax return. Form 40 is the Idaho income tax return for Idaho residents.

Oil and Gas Production Tax. You can prepare and e-file your IRS and Idaho State Tax Return. The Idaho tax filing and tax payment deadline is April 18 2022.

1 2005 contact us in the. Electricity Kilowatt Hour Tax. The decedent and their estate are separate taxable entities.

An estates tax ID number is called. In accordance with Sections 63-105 and 14-539 Idaho Code the State Tax. 13 April 2013 Author.

Letter to Internal Revenue Service transmitting Federal Estate. For more details on Idaho estate tax requirements for deaths before Jan. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

IDAHO ADMINISTRATIVE CODE IDAPA 350104 - Idaho Estate Transfer State Tax Commission Tax Administrative Rules Page 4 IAC 2011 01. You should file the estate tax return to report the sale of the property and to submit a copy of the K-1 schedules to the IRS. There is an 1170 million million exemption for the.

Instructions are in a separate file. Payment of any additional tax due together with. 350104 - IDAHO ESTATE AND TRANSFER TAX ADMINISTRATIVE RULES.

However like all other states it has its own inheritance laws including the ones that cover what happens. If your estate is large enough you still may have to worry about the federal estate tax though. County tax rates range throughout the state.

A copy of any filing by the. If the Idaho Fiduciary Income Tax Return Form 66 is filed within. Understand typical refund time frames.

The information from the federal estate tax return. A homeowner with a property in. Idaho residents must file if their gross income for 2021 is at.

How To File Taxes For Free In 2022 Money

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Banking Suvidha Income Tax Return Itr Pan Aadhaar Tax Saving F Personal Injury Lawyer Injury Lawyer Estate Planning Attorney

Idaho Estate Tax Everything You Need To Know Smartasset

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Will The Irs Extend The Tax Deadline In 2022 Marca

Filing An Idaho State Tax Return Things To Know Credit Karma Tax

Understanding The 1065 Form Scalefactor

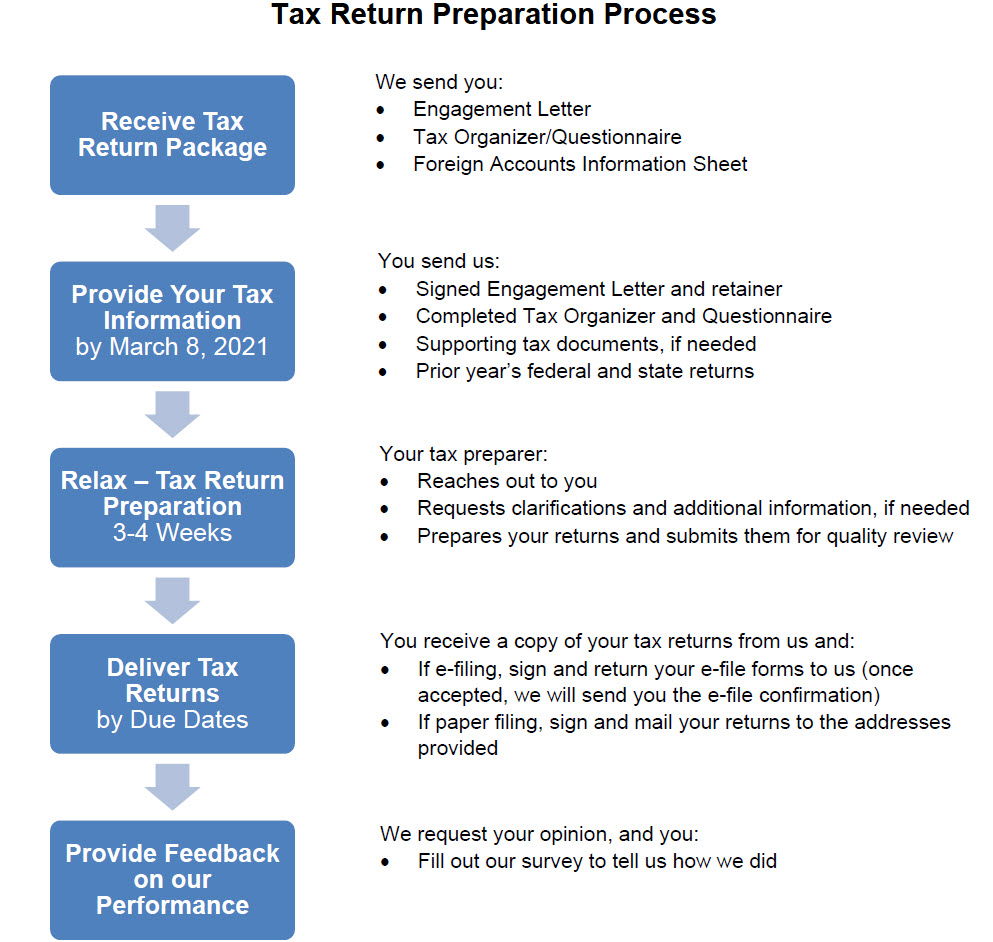

Tax Return Information The Wolf Group

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

How Your Idaho Income Tax Refund Can Process Faster Tax Refund Tax Help Income Tax